Turners Automotive Group posts record $38.6m net profit

Words/Images NZ Autocar

Turners Automotive Group has delivered a record net profit after tax of $38.6 million for the financial year ending March 31. That’s up 17 per cent on the prior year, rounding off what the company describes as “a decade of sustainable growth”.

The FY25 result also saw earnings per share climb to 43.3 cents (also up 17 per cent). Total annual dividends rise to 29 cents per share. That’s up 14 per cent year-on-year. It is also nearly three times the 10 cents per share paid a decade earlier.

Turners says the result reinforces the strength of its diversified business model. And it puts it ahead of schedule on reaching its FY28 targets.

Despite hardships in the broader economy, Turners lifted its net profit before tax by 10 per cent to $54.3m. EBIT increased 6 per cent to $62.3m on turnover of $414.2m.

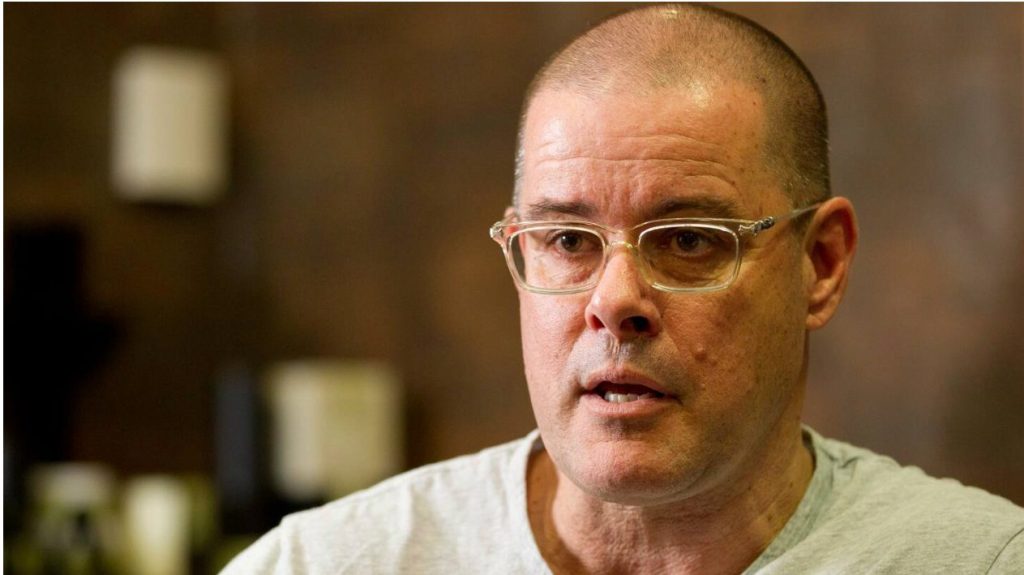

Turners chief executive Todd Hunter said the result reflects strong operational performance across the company’s core divisions.

“Our team has worked incredibly hard to ensure that some of the toughest economic conditions we’ve faced didn’t derail our growth strategy” he added.

“Auto retail remains our largest division, and the pressure it faced in the first half was no small matter. But even in worse conditions than the GFC, we proved that demand for used vehicles is resilient. Though margins were squeezed for a period, our ability to proactively manage margins during the recovery in H2 was pleasing.”

“With auto retail now firmly back in growth mode, we enter FY26 with strong momentum across all segments. We are on track to reach our FY28 targets earlier than expected.

“Our Tina brand refresh and new campaign launch reflect continued investment in a proven formula that is delivering strongly,” Hunter says.

The company says growth in its finance, insurance and credit management divisions offset earlier pressure in auto retail. Finance profit rose 31 per cent to $16m, insurance grew 13 per cent to $16.2m, and credit management lifted profit 11 per cent to $3.5m.

Chairman Grant Baker says the FY25 result validates the company’s long-term strategy.

“We‘ve always believed that used auto sales are less cyclical than many retail segments. By deliberately diversifying…we can create a sustainable, profitable business for our shareholders.

“With the economic cycle returning to a more positive mode, and with our competitive advantages, we are well positioned. That’s thanks to a dedicated team, leading brand, robust balance sheet, and growing physical and digital retail channels.

“We are confident this platform will continue to generate shareholder value well into the future. That’s also for the many team members who are now shareholders themselves,” Baker said.

Turners now expects to meet or exceed its FY28 goal of $65m NPBT ahead of schedule. That’s thanks to continued branch rollout, rising market share, and increased contributions from its annuity-style Finance and Insurance businesses.