June new vehicle registrations up on Fieldays activity

Words/Images NZ Autocar

New vehicle registrations were up in June 2025, reversing the market’s recent downward trend and delivering the strongest monthly result so far this year.

A total of 11,851 new vehicles were registered across the passenger and commercial sectors. That’s up 27.2 per cent compared with a year earlier.

Passenger vehicle registrations of 8239 units were up by just over one-third year-on-year. The commercial sector recorded 3612 registrations, a more modest rise of just over eight per cent compared with a year ago.

The result marks a significant shift in momentum which is likely in large part explained by the Fieldays effect. The government’s Investment Boost programme probably also contributed.

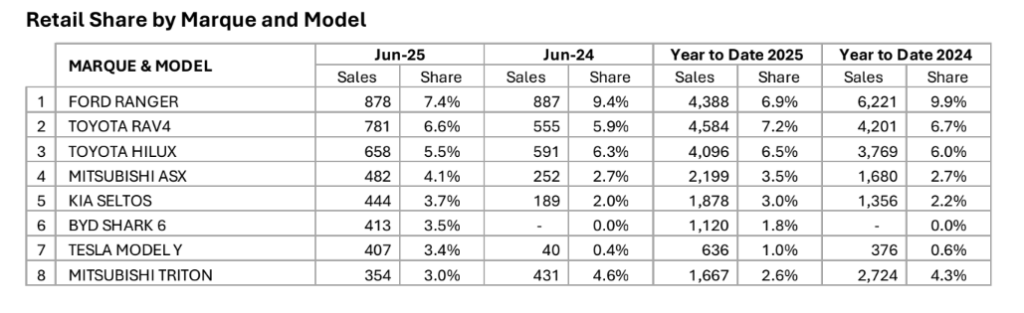

The passenger market rose by 36 per cent in June with RAV4 once again a big winner. Toyota reported 781 new RAV4 registrations, well ahead of second-placed Mitsubishi ASX (481) and Kia Seltos (444). The Tesla Model Y followed with 407 units sold, following its recent renewal.

Chinese brands continued their climb, with GWM’s Haval H6 posting 241 units, and the BYD Sealion 6 good for 172 registrations. Qashqai, Outback, and the LandCruiser Prado also featured in June’s top 20.

Several manufacturers posted triple-digit growth, including Tesla (up 327 per cent), BYD (up 315 per cent), and Nissan (up 214 per cent) compared with June 2024. Kia, MG, Subaru, and Mazda also reported solid gains.

Toyota led the passenger market by overall with 1525 registrations, increasing its share to 18.5 per cent. It was followed by Kia (835), Mitsubishi (808), Tesla (457), and BYD (415).

Other top 10 makes included GWM (366), Ford (345), Suzuki (329), Nissan (314), and Mazda (301).

The commercial sector returned to growth in June, supported by Fieldays activity and new model momentum. The Ford Ranger remained the country’s top commercial vehicle with 876 registrations, followed by the Toyota Hilux on 658. BYD’s Shark 6 took third place with 412 units, attaining decent numbers this year.

Ford retained its overall lead with 989 commercial registrations, ahead of Toyota (853), BYD (412), Mitsubishi (355), and Nissan (240). LDV (106) and GWM (64) also featured.

BYD’s strong result, up from zero commercial units in June 2024, gave it an 11.4 per cent share of the commercial market.

Fieldays-linked sales and growing diversity in the ute and van segments contributed to the commercial sector’s positive showing.