EV sales globally are accelerating

Words NZ Autocar | Images CarNewsChina, ChargeNet

Electric vehicles (EVs) are poised to account for over 40 per cent of global new car sales by 2030, according to the International Energy Agency (IEA).

This rapid transition will save more than five million barrels of oil being consumed per day by 2030. China alone contributes half of that reduction due to its dominant position in the EV market.

In 2024, global EV sales exceeded 17 million units, or 14 per cent of all new car sales. The IEA projects that this momentum will continue into 2025. It expect more than 20 million EVs will be sold, or 25 per cent of all car sales globally. The first quarter of 2025 already showed a 35 per cent year-on-year sales increase.

Regional Leaders and Trends

According to the GoAuto article, China remains the global EV leader, with electric vehicles comprising nearly half of all car sales in 2024. Over 11 million EVs were sold in China last year, surpassing total global EV sales from just two years prior. The IEA projects that EVs will constitute about 60 per cent of all new car sales in China by 2025. This growth is driven by aggressive government incentives and falling EV prices. Many electric models in China are already cheaper than conventional vehicles, even without subsidies.

In Europe, EV adoption is also strong, bolstered by stringent CO₂ emissions regulations. The IEA expects EVs to reach close to 60 per cent of new car sales in Europe by 2030, with a 25 per cent share anticipated by the end of this year.

The United States is experiencing slower EV growth. Electric vehicles accounted for about 10 per cent of total U.S. car sales in 2024. The IEA projects the share could reach 11 per cent in 2025, depending on the continuation of existing tax credits. However, policy uncertainty and infrastructure limitations are seen as barriers to more rapid growth.

EV sales are also increasing in Southeast Asia, but EV adoption is slow in African nations. By contrast, it is rapidly rising in Latin America and broader Asia, outside of China, with a 60 per cent sales jump in 2024. Chinese imports played a dominant role, comprising the majority of the market in Brazil and Thailand. Sales in these emerging markets are forecast to reach one million in 2025.

Key Challenges

The IEA highlights three major obstacles to sustained EV growth: economic uncertainty, high purchase prices relative to ICE power cars, and lagging charging infrastructure. While battery costs are falling, EVs still command a premium in many markets. For example, they cost 20 per cent more in Germany and 30 per cent more in the U.S. However, in countries like China and Thailand, EVs have already achieved or surpassed price parity.

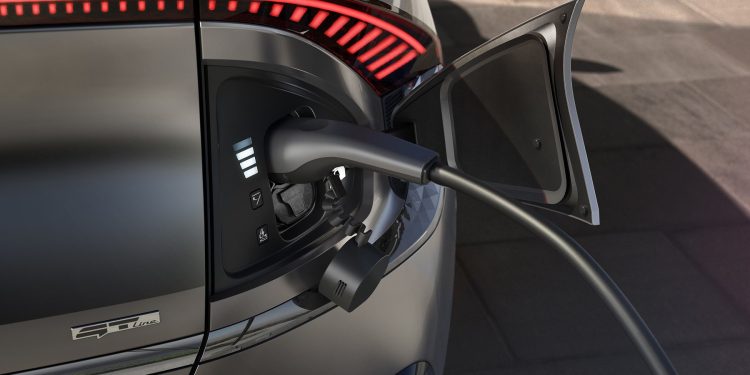

Infrastructure is another concern. Public charging availability in the U.S. and UK is not keeping pace with EV deployment, leading to congestion at charging points. Globally, the IEA estimates public charging infrastructure must grow nearly ninefold by 2030 to meet demand.

Outlook and Industry Dynamics

China remains the world’s EV production hub, accounting for over 70 per cent of global output and 40 per cent of exports. Chinese EVs are increasingly penetrating new markets like Brazil, Mexico, and Southeast Asia. Meanwhile, global EV trade grew by 20 per cent in 2024.

Technological advances, including a 30 per cent drop in battery costs in China and rapid expansion of ultra-fast charging infrastructure, are also fueling the transition. Government initiatives, smart charging, and grid integration are viewed as essential for long-term adoption.

Overall, the global EV market is growing strongly, led by China, supported by Europe, and expanding in emerging markets. While policy and infrastructure challenges remain, ongoing technological advancements and falling prices are expected to support continued acceleration towards 2030 targets.