China puts new restrictions on EV battery technology

Words NZ Autocar | Images CATL, Recurrent

China has placed new export restrictions on technologies critical for producing EV batteries. The move is probably to consolidate its dominance in the sector.

Technologies used to manufacture EV batteries and process lithium were added to the government’s export control list.

Inclusion on the list means that transferring the technologies overseas will require a government-issued license.

The new controls mirror those introduced three months ago on certain rare earth elements and their magnets. Such items are critical to EV production, consumer electronics and military equipment. China’s dominance of the rare earths supply chain is a potent tool in a trade war with the United States.

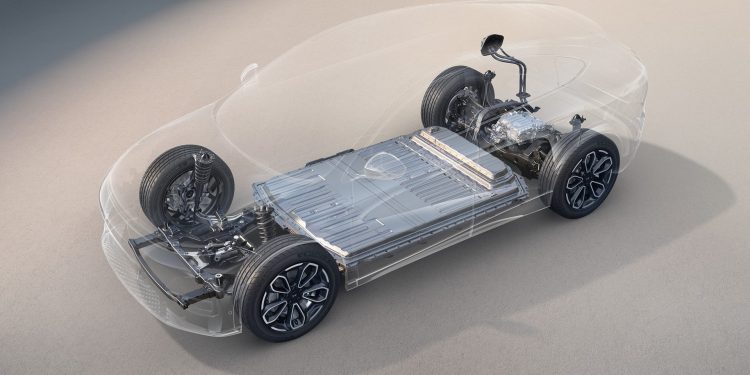

China must now be seen as the leading player in the global EV market, primarily because of its ability to develop new batteries through its comprehensive supply chain.

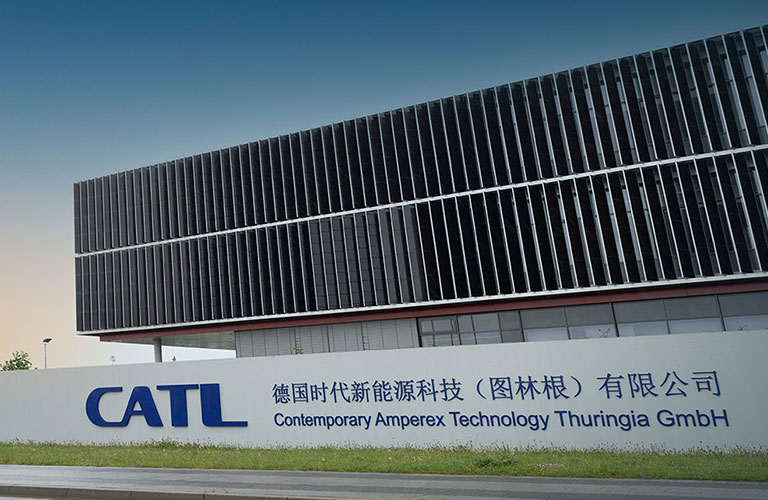

Many global car makers rely on China supplying batteries for their EVs. Chinese EV battery makers evidently control two-thirds of the global market share.

Another reason China may be instituting licensing requirements is because the EU has followed America and placed tariffs on Chinese car exports. The reason is they want the Chinese car makers to build their cars in European factories. As it happens, some Chinese battery makers already have plans to localise production in SE Asian and American markets.

Officials in China suggest the restrictions are there to safeguard national economic security and development interests. They also aim to promote international economic and technological cooperation.

The move, however, may accelerate efforts by the US, EU and others to boost localisation of precursor materials and metal refining capabilities.

China’s CATL, the world’s largest EV battery producer and a key supplier to Tesla, has plants in Germany and Hungary and has plans for a joint venture factory in Spain with Stellantis. It is also licensing its technology to be used in a Ford EV battery plant being built in Michigan.

World EV sales leader, BYD, already has EV production facilities outside of China, in Hungary, Thailand and Brazil. However, these are just assembly plants; the battery cells are still made in China.

So the true impact of the new export controls remains uncertain. The ultimate outcome may depend on how easy it is for companies to obtain permits.

China’s dominance in EV batteries

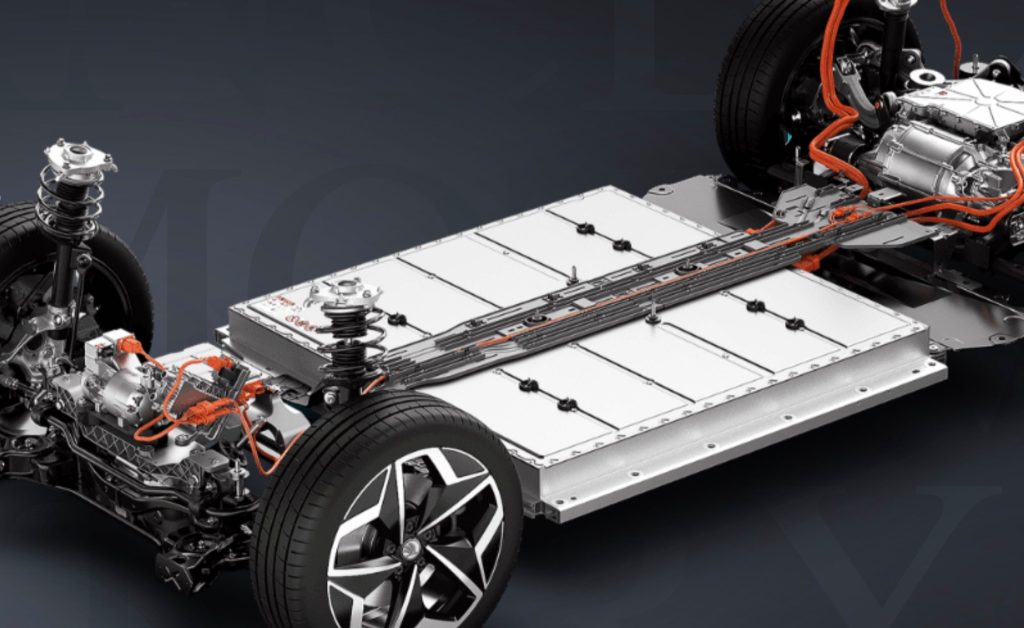

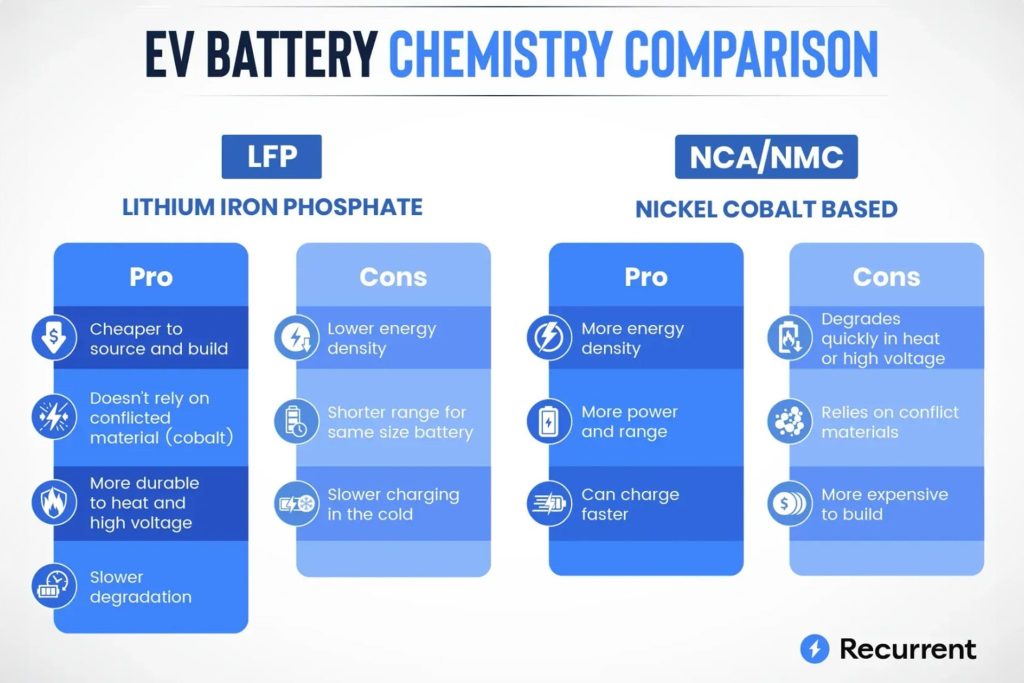

One aspect of the new restrictions surrounds production of the cathode for LFP batteries. Another focuses on the processing, refinement and extraction of lithium.

China dominates the production of LFP batteries and the processing of lithium globally. Last year, it held 94 per cent market share for LFP production capacity and provided 70 per cent of global processed lithium production.

LFP batteries now amount to just under one-half of the global EV market. Currently, they are mainly used in Chinese EVs to contain costs.

LFP’s lower energy density is acceptable given its much lower cost, so it dominates entry-level EVs. Car makers in the EU and US are quickly adopting the chemistry. However, even if LFP is produced outside of China, suppliers there still play a key role in providing items essential for LFP cathodes.

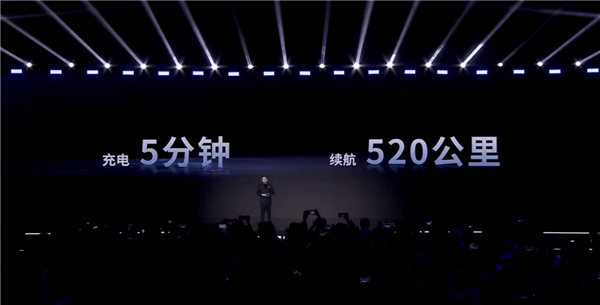

China is also forging ahead with LFP technology. BYD now has its “Super E-Platform” that allows the addition of 400km of range in five minutes. By comparison Tesla Superchargers can add 320km in 15 min.

CATL has upped the ante further, its upgraded LFP chemistry adding over 500km in five minutes. LFP technology not only lasts longer (five times as many cycles as NMC) but is also considered safer, being much less likely to undergo thermal runaway.